Page 35 - NZPM Annual Report 2020

P. 35

NZPM GROUP LIMITED

Notes to the Consolidated Financial Statements for the year ended 31 March 2020

The Group has applied an incremental borrowing rate to each type of asset in its portfolio. The property assets have been grouped

into four types (Auckland warehouse, Auckland and Queenstown properties, other large city properties and other regional properties)

with each type having three lease durations (under 5 years, 6 to 11 years, 12 years and over). The incremental borrowing rate for

vehicles and other equipment is the rate implied in the individual lease agreement.

Incremental borrowing rates: Per annum

Auckland warehouse 4.75%

Auckland and Queenstown properties 5.05% – 5.75%

Other large New Zealand city properties 5.55% – 6.25%

Other regional properties 5.80% – 6.50%

Vehicles 6.00% – 8.25%

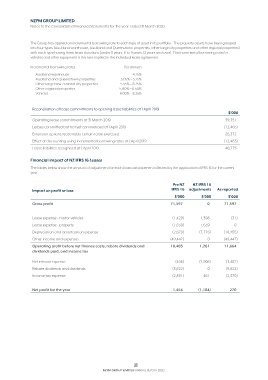

Reconciliation of lease commitments to opening lease liabilities at 1 April 2019

$’000

Operating lease commitments at 31 March 2019 39,351

Leases committed but not yet commenced at 1 April 2019 (12,465)

Extension options reasonably certain to be exercised 26,372

Effect of discounting using incremental borrowing rates at 1 April 2019 (12,483)

Lease liabilities recognised at 1 April 2019 40,775

Financial impact of NZ IFRS 16 Leases

The tables below show the amount of adjustment for each financial statement affected by the application of IFRS 16 for the current

year.

Pre NZ NZ IFRS 16

Impact on profit or loss IFRS 16 adjustments As reported

$’000 $’000 $’000

Gross profit 71,597 0 71,597

Lease expense - motor vehicles (1,429) 1,398 (31)

Lease expense - property (7,639) 7,639 0

Depreciation and amortisation expense (2,679) (7,776) (10,455)

Other income and expenses (49,447) 0 (49,447)

Operating profit before net finance costs, rebate dividends and 10,403 1,261 11,664

dividends paid, and income tax

Net interest expense (496) (2,906) (3,402)

Rebate dividends and dividends (5,622) 0 (5,622)

Income tax expense (2,831) 461 (2,370)

Net profit for the year 1,454 (1,184) 270

33

NZPM GROUP LIMITED ANNUAL REPORT 2020