Page 36 - NZPM Annual Report 2020

P. 36

NZPM GROUP LIMITED

Notes to the Consolidated Financial Statements for the year ended 31 March 2020

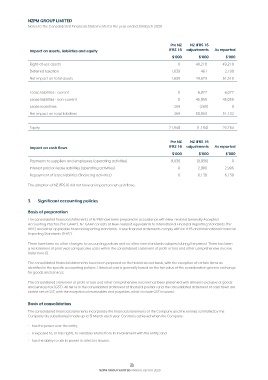

Pre NZ NZ IFRS 16

Impact on assets, liabilities and equity IFRS 16 adjustments As reported

$’000 $’000 $’000

Right-of-use assets 0 49,218 49,218

Deferred taxation 1,639 461 2,100

Net impact on total assets 1,639 49,679 51,318

Lease liabilities - current 0 6,077 6,077

Lease liabilities - non-current 0 45,055 45,055

Lease incentives 269 (269) 0

Net impact on total liabilities 269 50,863 51,132

Equity 21,948 (1,184) 20,764

Pre NZ NZ IFRS 16

Impact on cash flows IFRS 16 adjustments As reported

$’000 $’000 $’000

Payments to suppliers and employees (operating activities) 9,036 (9,036) 0

Interest paid on lease liabilities (operating activities) 0 2,906 2,906

Repayment of lease liabilities (financing activities) 0 6,130 6,130

The adoption of NZ IFRS 16 did not have an impact on net cash flows.

3. Significant accounting policies

Basis of preparation

The consolidated financial statements of NZPM have been prepared in accordance with New Zealand Generally Accepted

Accounting Practice (‘NZ GAAP’). NZ GAAP consists of New Zealand equivalents to International Financial Reporting Standards (‘NZ

IFRS’) and other applicable financial reporting standards. These financial statements comply with NZ IFRS and International Financial

Reporting Standards (‘IFRS’).

There have been no other changes to accounting policies and no other new standards adopted during the period. There has been

a restatement of prior year comparative costs within the consolidated statement of profit or loss and other comprehensive income

(refer note 6).

The consolidated financial statements have been prepared on the historical cost basis, with the exception of certain items as

identified in the specific accounting policies. Historical cost is generally based on the fair value of the consideration given in exchange

for goods and services.

The consolidated statement of profit or loss and other comprehensive income has been presented with all items exclusive of goods

and services tax (GST). All items in the consolidated statement of financial position and the consolidated statement of cash flows are

stated net of GST, with the exception of receivables and payables, which include GST invoiced.

Basis of consolidation

The consolidated financial statements incorporate the financial statements of the Company and the entities controlled by the

Company (its subsidiaries) made up to 31 March each year. Control is achieved when the Company:

• has the power over the entity;

• is exposed to, or has rights, to variable returns from its involvement with the entity; and

• has the ability to use its power to affect its returns.

34

NZPM GROUP LIMITED ANNUAL REPORT 2020