Page 46 - NZPM Annual Report 2020

P. 46

NZPM GROUP LIMITED

Notes to the Consolidated Financial Statements for the year ended 31 March 2020

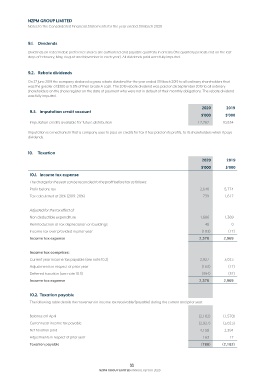

9.1. Dividends

Dividends on redeemable preference shares are authorised and payable quarterly in arrears (the quarterly periods end on the last

days of February, May, August and November in each year). All dividends paid were fully imputed.

9.2. Rebate dividends

On 27 June 2019 the company declared a gross rebate dividend for the year ended 31 March 2019 to all ordinary shareholders that

was the greater of $300 or 5.0% of their Grade A cash. The 2019 rebate dividend was paid on 26 September 2019 to all ordinary

shareholders on the share register on the date of payment who were not in default of their monthly obligations. The rebate dividend

was fully imputed.

2020 2019

9.3. Imputation credit account

$’000 $’000

Imputation credits available for future distribution 12,762 10,834

Imputation is a mechanism that a company uses to pass on credits for tax it has paid on its profits, to its shareholders when it pays

dividends.

10. Taxation

2020 2019

$’000 $’000

10.1. Income tax expense

The charge for the year can be reconciled to the profit before tax as follows:

Profit before tax 2,640 5,774

Tax calculated at 28% (2019: 28%) 739 1,617

Adjusted for the tax effect of:

Non deductible expenditure 1,686 1,369

Reintroduction of tax depreciation on buildings 48 0

Income tax over provided in prior year (103) (17)

Income tax expense 2,370 2,969

Income tax comprises:

Current year income tax payable (see note 10.2) 2,927 3,023

Adjustments in respect of prior year (163) (17)

Deferred taxation (see note 10.3) (394) (37)

Income tax expense 2,370 2,969

10.2. Taxation payable

The following table details the movement in income tax receivable/(payable) during the current and prior year.

Balance at 1 April (2,182) (1,570)

Current year income tax payable (2,927) (3,023)

Net taxation paid 4,158 2,394

Adjustments in respect of prior year 163 17

Taxation payable (788) (2,182)

44

NZPM GROUP LIMITED ANNUAL REPORT 2020