Page 48 - NZPM Annual Report 2020

P. 48

NZPM GROUP LIMITED

Notes to the Consolidated Financial Statements for the year ended 31 March 2020

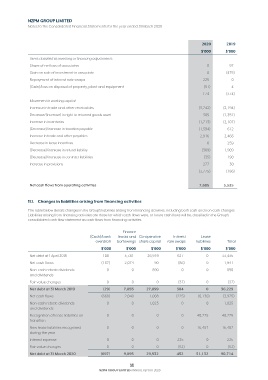

2020 2019

$’000 $’000

Items classified as investing or financing adjustments:

Share of net loss of associates 0 97

Gain on sale of investment in associate 0 (475)

Repayment of interest rate swaps 225 0

(Gain)/loss on disposal of property, plant and equipment (51) 4

174 (374)

Movement in working capital:

Increase in trade and other receivables (3,742) (2,194)

Decrease/(increase) in right to returned goods asset 305 (1,351)

Increase in inventories (1,713) (2,107)

(Decrease)/increase in taxation payable (1,394) 612

Increase in trade and other payables 2,916 2,466

Decrease in lease incentives 0 259

(Decrease)/increase in refund liability (389) 1,909

(Decrease)/increase in contract liabilities (35) 190

Increase in provisions 277 30

(3,775) (186)

Net cash flows from operating activities 7,605 5,535

11.1. Changes in liabilities arising from financing activities

The table below details changes in the Group’s liabilities arising from financing activities, including both cash and non-cash changes.

Liabilities arising from financing activities are those for which cash flows were, or future cash flows will be, classified in the Group’s

consolidated cash flow statement as cash flows from financing activities.

Finance

(Cash)/bank leases and Co-operative Interest Lease

overdraft borrowings share capital rate swaps liabilities Total

$’000 $’000 $’000 $’000 $’000 $’000

Net debt at 1 April 2018 108 5,781 26,919 627 0 33,435

Net cash flows (137) 2,074 90 (86) 0 1,941

Non-cash rebate dividends 0 0 890 0 0 890

and dividends

Fair value changes 0 0 0 (37) 0 (37)

Net debt at 31 March 2019 (29) 7,855 27,899 504 0 36,229

Net cash flows (668) 2,040 1,008 (225) (6,130) (3,975)

Non-cash rebate dividends 0 0 1,025 0 0 1,025

and dividends

Recognition of lease liabilities on 0 0 0 0 40,775 40,775

transition

New lease liabilities recognised 0 0 0 0 16,487 16,487

during the year

Interest expense 0 0 0 225 0 225

Fair value changes 0 0 0 (52) 0 (52)

Net debt at 31 March 2020 (697) 9,895 29,932 452 51,132 90,714

46

NZPM GROUP LIMITED ANNUAL REPORT 2020