Page 62 - NZPM Annual Report 2017

P. 62

NZPM GROUP ANNUAL REPORT 2017

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

For the year ended 31 March 2017

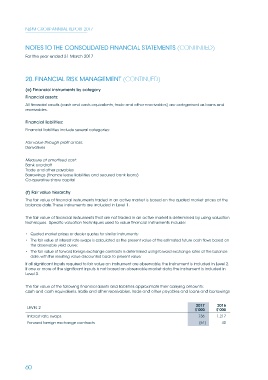

20. FINANCIAL RISK MANAGEMENT (CONTINUED)

(e) Financial instruments by category

Financial assets:

All financial assets (cash and cash equivalents, trade and other receivables) are categorised as loans and

receivables.

Financial liabilities:

Financial liabilities include several categories:

Fair value through profit or loss:

Derivatives

Measure at amortised cost:

Bank overdraft

Trade and other payables

Borrowings (finance lease liabilities and secured bank loans)

Co-operative share capital

(f) Fair value hierarchy

The fair value of financial instruments traded in an active market is based on the quoted market prices at the

balance date. These instruments are included in Level 1.

The fair value of financial instruments that are not traded in an active market is determined by using valuation

techniques. Specific valuation techniques used to value financial instruments include:

• Quoted market prices or dealer quotes for similar instruments;

• The fair value of interest rate swaps is calculated as the present value of the estimated future cash flows based on

the observable yield curve;

• The fair value of forward foreign exchange contracts is determined using forward exchange rates at the balance

date, with the resulting value discounted back to present value;

If all significant inputs required to fair value an instrument are observable, the instrument is included in Level 2.

If one or more of the significant inputs is not based on observable market data, the instrument is included in

Level 3.

The fair value of the following financial assets and liabilities approximate their carrying amounts:

cash and cash equivalents, trade and other receivables, trade and other payables and loans and borrowings

2017 2016

LEVEL 2

$’000 $’000

Interest rate swaps 736 1,217

Forward foreign exchange contracts (61) 40

60