Page 53 - NZPM Annual Report 2020

P. 53

NZPM GROUP LIMITED

Notes to the Consolidated Financial Statements for the year ended 31 March 2020

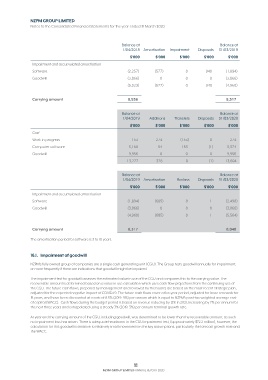

Balance at Balance at

1/04/2018 Amortisation Impairment Disposals 31/03/2019

$’000 $’000 $’000 $’000 $’000

Impairment and accumulated amortisation

Software (2,257) (577) 0 940 (1,894)

Goodwill (3,066) 0 0 0 (3,066)

(5,323) (577) 0 940 (4,960)

Carrying amount 8,536 8,317

Balance at Balance at

1/04/2019 Additions Transfers Disposals 31/03/2020

$’000 $’000 $’000 $’000 $’000

Cost

Work in progress 153 274 (153) 0 274

Computer software 3,168 54 153 (1) 3,374

Goodwill 9,956 0 0 0 9,956

13,277 328 0 (1) 13,604

Balance at Balance at

1/04/2019 Amortisation Reclass Disposals 31/03/2020

$’000 $’000 $’000 $’000 $’000

Impairment and accumulated amortisation

Software (1,894) (605) 0 1 (2,498)

Goodwill (3,066) 0 0 0 (3,066)

(4,960) (605) 0 1 (5,564)

Carrying amount 8,317 8,040

The amortisation period for software is 3 to 10 years.

16.1. Impairment of goodwill

NZPM’s fully owned group of companies are a single cash generating unit (CGU). The Group tests goodwill annually for impairment,

or more frequently if there are indications that goodwill might be impaired.

The impairment test for goodwill assesses the estimated value in use of the CGU and compares this to the carrying value. The

recoverable amount is determined based on a value in use calculation which uses cash flow projections from the continuing use of

the CGU. The future cash flows, prepared by management and reviewed by the board, are based on the most recent strategic plan,

adjusted for the expected negative impact of COVID-19. The future cash flows cover a five-year period, adjusted for lease renewals for

15 years, and have been discounted at a rate of 8.5% (2019: 9%) per annum which is equal to NZPM’s post-tax weighted average cost

of capital (WACC). Cash flows during the budget period is based on revenue reducing by 12% in 2021, increasing by 7% per annum for

the next three years and extrapolated using a steady 3% (2019: 3%) per annum terminal growth rate.

At year end the carrying amount of the CGU, including goodwill, was determined to be lower than the recoverable amount; as such

no impairment loss has arisen. There is adequate headroom in the CGU impairment test, (approximately $72.2 million), however, the

calculation for this goodwill is sensitive to relatively small movements in the key assumptions, particularly the forecast growth rate and

the WACC.

51

NZPM GROUP LIMITED ANNUAL REPORT 2020