Page 65 - NZPM Annual Report 2020

P. 65

NZPM GROUP LIMITED

Notes to the Consolidated Financial Statements for the year ended 31 March 2020

The Group had interest rate swap contracts of $7.5 million (2019: $7.5 million) outstanding at the end of the reporting period. During

the year no interest rate swaps were closed out (2019: $1.0 million closed out for a payment of $86,658) and no new interest rate swap

contracts were entered into (2019: $2.5 million).

The Group’s derivatives are not traded in an active market which means quoted prices are not available to determine the fair value.

To determine the fair value the Group uses valuation techniques which rely on observable market data.

The fair value of forward exchange contracts are determined using the forward exchange market rates at the balance date and

interest rate swaps are calculated as the present value of estimated future cash flows based on the applicable market interest yield

rates at balance date.

For accounting purposes (NZ IFRS 13) these valuations are deemed to be Level 2 fair value measurements as they are not derived from

a quoted price in an active market but rather, a valuation technique that relies on other observable market data.

32.4. Market risk

The Group’s activities expose it primarily to the financial risks of changes in foreign currency rates and interest rates. There has

been no change during the current reporting period to the Group’s exposure to market risks or the manner in which these risks are

managed and measured.

Foreign currency risk management

The Group purchases inventory directly from overseas suppliers, primarily priced in USD, AUD and EUR. In order to protect against

exchange rate movements and to manage the inventory costing process, the Group enters into forward exchange contracts to

purchase foreign currencies. These contracts hedge highly probable forecast purchases and are timed to mature when the payments

are scheduled to be settled. It is the policy of the Group to enter into foreign exchange forward contracts to manage the foreign

currency risk associated with anticipated purchase transactions out to 12 months. Management work to a board approved treasury

policy to manage this foreign exchange risk.

The policy parameters for hedging forecast currency exposures are:

• to hedge 80% to 100% of forecast commitments expected in the next 0 to 3 months;

• to hedge 40% to 8% of forecast commitments expected in the next 4 to 6 months;

• to hedge 0% to 50% of forecast commitments expected in the next 7 to 12 months.

The Group will only transact foreign currency hedging contracts with banking counterparties approved by the board.

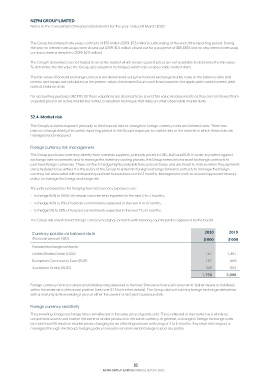

Currency position at balance date 2020 2019

(Notional amount NZD) $’000 $’000

Forward exchange contracts:

United States Dollar (USD) 767 1,467

European Community Euro (EUR) 137 669

Australian Dollar (AUD) 246 862

1,150 2,998

Foreign currency contract assets and liabilities are presented in the lines ‘Derivative financial instruments’ (either assets or liabilities)

within the statement of financial position (see note 32.3 for further details). The Group did not hold any foreign exchange derivatives

with a maturity date exceeding 1 year at either the current or last year’s balance date.

Foreign currency sensitivity

The prevailing foreign exchange rates are reflected in the sales price of goods sold. This is reflected in the market as a whole as

competitors source and market the same or similar products in the same currency. In general, a change in foreign exchange rates

by more than 5% results in market prices changing by an offsetting amount with a lag of 3 to 6 months. Any short term impact is

managed through the Group’s hedging policy to result in an immaterial change to post tax profits.

63

NZPM GROUP LIMITED ANNUAL REPORT 2020