Page 66 - NZPM Annual Report 2020

P. 66

NZPM GROUP LIMITED

Notes to the Consolidated Financial Statements for the year ended 31 March 2020

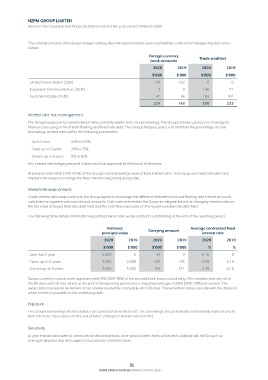

The carrying amounts of the Group’s foreign currency denominated monetary assets and liabilities at the end of the reporting date are as

follows:

Foreign currency Trade creditors

bank accounts

2020 2019 2020 2019

$’000 $’000 $’000 $’000

United States Dollar (USD) 179 102 0 0

European Community Euro (EUR) 3 0 146 71

Australian Dollar (AUD) 42 46 184 162

224 148 330 233

Interest rate risk management

The Group’s exposure to market interest rates primarily relates to its core borrowings. The Group’s treasury policy is to manage its

finance costs using a mix of both floating and fixed rate debt. The Group’s treasury policy is to maintain the percentage of core

borrowings at fixed rates within the following parameters:

• Up to 1 year 50% to 100%;

• 1 year up to 3 years 25% to 75%;

• 3 years up to 5 years 0% to 50%.

Any interest rate hedging beyond 3 years must be approved by the board of directors.

At balance date 100% (2019: 100%) of the Group’s core borrowings were at fixed interest rates. The Group uses fixed rate debt and

interest rate swaps to manage the fixed interest rate pricing and profile.

Interest rate swap contracts

Under interest rate swap contracts, the Group agrees to exchange the difference between fixed and floating rate interest amounts

calculated on agreed notional principal amounts. Such contracts enable the Group to mitigate the risk of changing interest rates on

the fair value of issued fixed rate debt held and the cash flow exposures on the issued variable rate debt held.

The following table details information regarding interest rate swaps contracts outstanding at the end of the reporting period.

Notional Average contracted fixed

principal value Carrying amount interest rate

2020 2019 2020 2019 2020 2019

$’000 $’000 $’000 $’000 % %

Less than 1 year 2,000 0 54 0 6.16 0

1 year up to 2 years 3,000 2,000 235 133 5.85 6.16

2 years up to 5 years 2,500 5,500 163 371 2.35 4.10

Swaps currently in place cover approximately 76% (2019: 95%) of the secured bank loans outstanding. The variable rates are set at

the 90 day bank bill rate, which at the end of the reporting period was a weighted average of 1.08% (2019: 1.91%) per annum. The

swap contracts require settlement of net interest receivable or payable each 90 days. The settlement dates coincide with the dates on

which interest is payable on the underlying debt.

Exposure

The Group’s borrowings and receivables are carried at amortised cost. The borrowings are periodically contractually repriced and to

that extent are also exposed to the risk of future changes in market interest rates.

Sensitivity

At year end all loans were at fixed rates for defined periods, after which interest rates will be reset. Additionally the Group has

overnight deposits that are subject to fluctuations of interest rates.

64

NZPM GROUP LIMITED ANNUAL REPORT 2020