Page 52 - NZPM Annual Report 2017

P. 52

NZPM GROUP ANNUAL REPORT 2017

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

For the year ended 31 March 2017

15. LOANS AND BORROWINGS (CONTINUED)

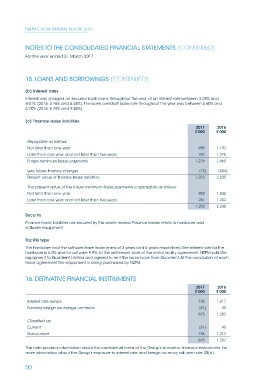

(b) Interest rates

Interest was charged on secured bank loans throughout the year at an interest rate between 3.28% and

4.01% (2016: 3.76% and 5.58%). The bank overdraft base rate throughout the year was between 5.60% and

5.70% (2016: 5.70% and 9.45%).

(c) Finance lease liabilities

2017 2016

$’000 $’000

Repayable as follows:

Not later than one year 989 1,193

Later than one year and not later than five years 287 1,276

Future minimum lease payments 1,276 2,469

Less future finance charges (73) (234)

Present value of finance lease liabilities 1,203 2,235

The present value of the future minimum lease payments is repayable as follows:

Not later than one year 922 1,032

Later than one year and not later than five years 281 1,203

1,203 2,235

Security

Finance lease liabilities are secured by the assets leased. Finance leases relate to hardware and

software equipment.

Facility type

The hardware and the software have lease terms of 3 years and 6 years respectively. The interest rate for the

hardware is 6.0% and for software 9.9%. At the settlement date of the rental facility agreement, NZPM sold the

equipment to Quadrent Limited and agreed to rent the same back from Quadrent. At the conclusion of each

lease agreement the equipment is being purchased by NZPM.

16. DERIVATIVE FINANCIAL INSTRUMENTS

2017 2016

$’000 $’000

Interest rate swaps 736 1,217

Forward foreign exchange contracts (61) 40

675 1,257

Classified as:

Current (61) 40

Non-current 736 1,217

675 1,257

This note provides information about the contractual terms of the Group’s derivative financial instruments. For

more information about the Group’s exposure to interest rate and foreign currency risk, see note 20(a).

50