Page 49 - NZPM Annual Report 2017

P. 49

Key assumptions with respect to the value in use calculations include:

• Revenue growth rates ranging from 2% to 5% during the 5 year forecast period (2016: 2% to 5%).

• Terminal growth rate of 3% (2016: 3%)

• Post tax weighted average cost of capital (WACC) of 9% (2016: 9%).

At year end the carrying amount of the CGU, including goodwill, was determined to be lower than the

recoverable amount; as such no impairment loss has arisen. There is adequate headroom in the CGU

impairment test, (approximately $41,200,000), but the calculation for this goodwill is sensitive to relatively small

movements in the key assumptions, particularly the forecast growth rate and cash flows during the 5 year

forecast period and the WACC.

(ii) Sensitivity analysis

In relation to the goodwill attached to the CGU, it is estimated that a +1% movement in the terminal

growth rate used in the calculation would result in a corresponding movement in the recoverable amount

of $15,000,000; a -1% movement in the terminal growth rate used in the calculation would result in a

corresponding movement in the recoverable amount of ($10,000,000). Similarly a +1% movement in the

discount rate would alter the recoverable amount by ($13,000,000) and a -1% movement in the discount rate

would alter the recoverable amount by $18,000,000.

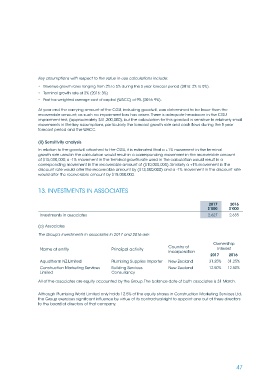

13. INVESTMENTS IN ASSOCIATES

2017 2016

$’000 $’000

Investments in associates 2,627 2,635

(a) Associates

The Group’s investments in associates in 2017 and 2016 are:

Ownership

Country of

Name of entity Principal activity Interest

incorporation

2017 2016

Aquatherm NZ Limited Plumbing Supplies Importer New Zealand 31.25% 31.25%

Construction Marketing Services Building Services New Zealand 12.50% 12.50%

Limited Consultancy

All of the associates are equity accounted by the Group. The balance date of both associates is 31 March.

Although Plumbing World Limited only holds 12.5% of the equity shares in Construction Marketing Services Ltd,

the Group exercises significant influence by virtue of its contractual right to appoint one out of three directors

to the board of directors of that company.

47