Page 54 - NZPM Annual Report 2020

P. 54

NZPM GROUP LIMITED

Notes to the Consolidated Financial Statements for the year ended 31 March 2020

Sensitivity analysis

In relation to the goodwill attached to the CGU, it is estimated that a +1% movement in the terminal growth rate used in the calculation

would result in a corresponding movement in the recoverable amount of $26.5 million; a -1% movement in the terminal growth

rate used in the calculation would result in a corresponding movement in the recoverable amount of ($18.8 million). Similarly a +1%

movement in the discount rate would alter the recoverable amount by ($23.0 million).

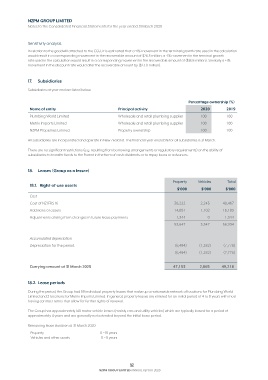

17. Subsidiaries

Subsidiaries at year end are listed below.

Percentage ownership (%)

Name of entity Principal activity 2020 2019

Plumbing World Limited Wholesale and retail plumbing supplier 100 100

Metrix Imports Limited Wholesale and retail plumbing supplier 100 100

NZPM Properties Limited Property ownership 100 100

All subsidiaries are incorporated and operate in New Zealand. The financial year end date for all subsidiaries is 31 March.

There are no significant restrictions (e.g. resulting from borrowing arrangements or regulatory requirements) on the ability of

subsidiaries to transfer funds to the Parent in the form of cash dividends or to repay loans or advances.

18. Leases (Group as a lessee)

Property Vehicles Total

18.1. Right-of-use assets

$’000 $’000 $’000

Cost

Cost of NZ IFRS 16 38,222 2,245 40,467

Additions of assets 14,081 1,102 15,183

Adjustments arising from changes in future lease payments 1,344 0 1,344

53,647 3,347 56,994

Accumulated depreciation

Depreciation for the period (6,494) (1,282) (7,776)

(6,494) (1,282) (7,776)

Carrying amount at 31 March 2020 47,153 2,065 49,218

18.2. Lease periods

During the period, the Group had 59 individual property leases that make up a nationwide network of locations for Plumbing World

Limited and 2 locations for Metrix Imports Limited. In general, property leases are entered for an initial period of 4 to 8 years with most

having contract terms that allow for further rights of renewal.

The Group has approximately 140 motor vehicle leases (mainly cars and utility vehicles) which are typically leased for a period of

approximately 4 years and are generally not extended beyond the initial lease period.

Remaining lease duration at 31 March 2020:

Property 0 – 15 years

Vehicles and other assets 0 – 5 years

52

NZPM GROUP LIMITED ANNUAL REPORT 2020