Page 55 - NZPM Annual Report 2020

P. 55

NZPM GROUP LIMITED

Notes to the Consolidated Financial Statements for the year ended 31 March 2020

At 31 March 2020, the Group had entered into new contracts for property, vehicle and photocopier leases which had not commenced

by the year-end. As a result, a lease liability and right-of-use asset has not been recognised. The estimated aggregate future cash

outflows to which the Group is exposed in respect of these contracts is $2.0 million.

As at 31 March 2020, the Group is committed to $122,000 short-term leases.

19. Investments in associates

During and at the end of the reporting period the Group had no associates.

In the prior year, the Group held a 12.5% interest in Construction Marketing Services Limited and accounted for the investment as an

associate. On 17 December 2018, the Group sold its minority shareholding in Construction Marketing Services Limited for proceeds of

$1.6 million. This transaction resulted in the recognition of a gain in profit or loss of $474,509.

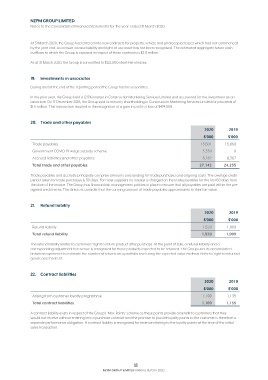

20. Trade and other payables

2020 2019

$’000 $’000

Trade payables 15,501 15,868

Government COVID-19 wage subsidy scheme 3,359 0

Accrued liabilities and other payables 8,282 8,367

Total trade and other payables 27,142 24,235

Trade payables and accruals principally comprise amounts outstanding for trade purchases and ongoing costs. The average credit

period taken for trade purchases is 30 days. For most suppliers no interest is charged on the trade payables for the first 60 days from

the date of the invoice. The Group has financial risk management policies in place to ensure that all payables are paid within the pre-

agreed credit terms. The directors consider that the carrying amount of trade payables approximates to their fair value.

21. Refund liability

2020 2019

$’000 $’000

Refund liability 1,520 1,909

Total refund liability 1,520 1,909

The refund liability relates to customers’ right to return product after purchase. At the point of sale, a refund liability and a

corresponding adjustment to revenue is recognised for those products expected to be returned. The Group uses its accumulated

historical experience to estimate the number of returns on a portfolio level using the expected value method. Refer to ‘right to returned

goods asset’ note 13.

22. Contract liabilities

2020 2019

$’000 $’000

Arising from customer loyalty programme 1,100 1,135

Total contract liabilities 1,100 1,135

A contract liability exists in respect of the Group’s ‘Max-Points’ scheme as these points provide a benefit to customers that they

would not receive without entering into a purchase contract and the promise to provide loyalty points to the customer is therefore a

separate performance obligation. A contract liability is recognised for revenue relating to the loyalty points at the time of the initial

sales transaction.

53

NZPM GROUP LIMITED ANNUAL REPORT 2020