Page 57 - NZPM Annual Report 2020

P. 57

NZPM GROUP LIMITED

Notes to the Consolidated Financial Statements for the year ended 31 March 2020

Bank loans

On 14 February 2019, a separate wholesale term loan of $3.1 million was drawn down for a property purchase. Repayments of $5,000

commenced one month after drawdown and continue monthly thereafter.

The loan has been secured over:

• the present and after acquired assets of NZPM Properties Limited by way of a General Security Agreement (GSA);

• an all obligations cross guarantee from and between NZPM Group Limited and subsidiaries;

• an exclusive mortgage over a property in Papanui, Christchurch; and

• an exclusive mortgage over a property in Kingsland, Auckland.

The maturity date of the loan is 31 December 2021. The bank loan is priced on Westpac’s 90 day Bank Bill Bid Rate plus a margin of

2.25% (2019: 2.25%) per annum. At 31 March 2020 the applicable interest rate was 3.65% per annum. For the wholesale term loan

facility, the amount owed to Westpac must not exceed 60% of the value (as determined by Westpac NZ) of the mortgaged properties

and all the other of the assets charged to Westpac NZ.

23.4. Loan covenants

Under the terms of the major borrowing facilities with the bank, the Group is required to comply with the following financial

covenants:

Funding cost cover ratio

• adjusted EBIT, (earnings before non-recurring items, interest and tax), for the Group against its total borrowing costs (including

cash flows for derivative instruments but excluding market value changes of the derivative instruments), and is required to exceed

this ratio by 1.5 times. The funding cost cover ratio is tested on a rolling 12 month basis.

Quasi-equity ratio

• an equity ratio of 40% which excludes intangible assets, investment in associates, advances to and from subsidiaries and co-

operative share capital.

Liquidity ratio

• a liquidity ratio whereby the aggregate value of stock and trade debtors is at least 1.5 times the value of trade creditors and all

outstanding balances due to Westpac under the Facility Agreement.

The Group has agreed with Westpac that the covenants are to be measured without the application of NZ IFRS 16. These covenants

are calculated at the end of each month and are reported to the bank quarterly. The Group has complied with these covenants

throughout the current reporting period and the previous period.

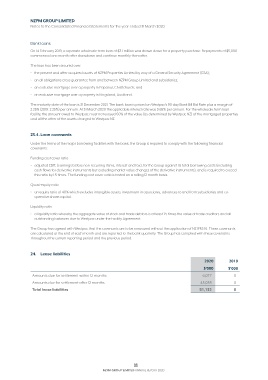

24. Lease liabilities

2020 2019

$’000 $’000

Amounts due for settlement within 12 months 6,077 0

Amounts due for settlement after 12 months 45,055 0

Total lease liabilities 51,132 0

55

NZPM GROUP LIMITED ANNUAL REPORT 2020