Page 44 - NZPM Annual Report 2017

P. 44

NZPM GROUP ANNUAL REPORT 2017

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

For the year ended 31 March 2017

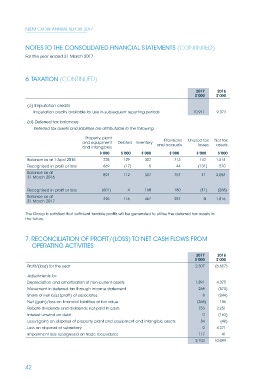

6. TAXATION (CONTINUED)

2017 2016

$’000 $’000

(c) Imputation credits

Imputation credits available for use in subsequent reporting periods 10,911 9,373

(d) Deferred tax balances

Deferred tax assets and liabilities are attributable to the following:

Property, plant

and equipment Debtors Inventory Provisions Unused tax Net tax

and intangibles and accruals losses assets

$’000 $’000 $’000 $’000 $’000 $’000

Balance as at 1 April 2015 228 129 302 713 142 1,514

Recognised in profit or loss 669 (17) 5 44 (131) 570

Balance as at 897 112 307 757 11 2,084

31 March 2016

Recognised in profit or loss (601) 4 160 180 (11) (268)

Balance as at

31 March 2017 296 116 467 937 0 1,816

The Group is satisfied that sufficient taxable profits will be generated to utilise the deferred tax assets in

the future.

7. RECONCILIATION OF PROFIT/(LOSS) TO NET CASH FLOWS FROM

OPERATING ACTIVITIES

2017 2016

$’000 $’000

Profit/(loss) for the year 2,307 (6,657)

Adjustments for:

Depreciation and amortisation of non-current assets 1,891 4,375

Movement in deferred tax through income statement 268 (570)

Share of net loss/(profit) of associates 8 (244)

Net (gain)/loss on financial liabilities at fair value (368) 186

Rebate dividends and dividends not paid in cash 753 2,251

Interest unwind on debt 0 (163)

Loss/(gain) on disposal of property, plant and equipment and intangible assets 34 (48)

Loss on disposal of subsidiary 0 4,271

Impairment loss recognised on trade receivables 117 41

2,703 10,099

42