Page 43 - NZPM Annual Report 2017

P. 43

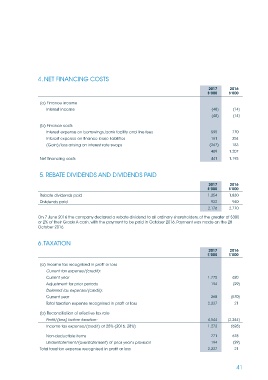

4. NET FINANCING COSTS

2017 2016

$’000 $’000

(a) Finance income

Interest income (48) (14)

(48) (14)

(b) Finance costs

Interest expense on borrowings, bank facility and line fees 595 770

Interest expense on finance lease liabilities 161 254

(Gain)/loss arising on interest rate swaps (267) 183

489 1,207

Net financing costs 441 1,193

5. REBATE DIVIDENDS AND DIVIDENDS PAID

2017 2016

$’000 $’000

Rebate dividends paid 1,254 1,830

Dividends paid 922 940

2,176 2,770

On 7 June 2016 the company declared a rebate dividend to all ordinary shareholders, of the greater of $300

or 2% of their Grade A cash, with the payment to be paid in October 2016. Payment was made on the 28

October 2016.

6. TAXATION

2017 2016

$’000 $’000

(a) Income tax recognised in profit or loss

Current tax expense/(credit):

Current year 1,775 620

Adjustment for prior periods 194 (29)

Deferred tax expense/(credit):

Current year 268 (570)

Total taxation expense recognised in profit or loss 2,237 21

(b) Reconciliation of effective tax rate

Profit/(loss) before taxation: 4,544 (2,244)

Income tax expense/(credit) at 28% (2016: 28%) 1,272 (628)

Non-deductible items 771 678

Understatement/(overstatement) of prior year's provision 194 (29)

Total taxation expense recognised in profit or loss 2,237 21

41